Is Your Property in Melbourne Underperforming? Discover the Short-Term Rental System That Boosts Returns by 63% in Just 3 Weeks

Increase your rental income without buying more property, taking on debt, or doing extra work.

Jordan Pham

Last updated 18 December 2025

EXPERIENCE WITH

Melbourne’s Rental Market Is Shifting Faster Than Many Realise

A growing number of Melbourne property investors are discovering that the traditional long-term rental model is quietly costing them thousands in lost income every month.

Recent figures suggest that as many as seven in ten investors are underperforming their property’s potential returns by an average of 63% — not because they own the wrong property, but because they’re using outdated management structures.

The Limits of Traditional Advice

For decades, the dominant advice for investors has been simple: buy more property to make more money.

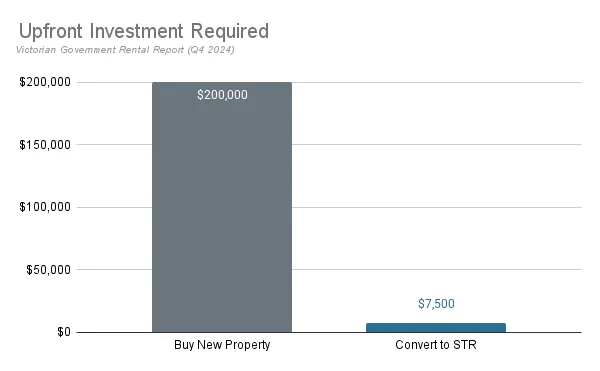

But in 2025, the economics of that advice look increasingly strained. For example, adding just ~$4,000 per month in extra rental income typically requires:

A $200,000 deposit on a $1 million property

Around $800,000 in new debt

Settlement delays, additional maintenance, and financing risk

And that’s before mortgage repayments are taken into account.

It’s little wonder many investors are questioning whether “buy more” is still the smartest play.

A $200,000 deposit is typically required to add ~$4,000 in monthly rent via a new purchase, compared to ~$7,500 for a short-term rental conversion.

Why Margins Are Under Pressure

Even for those who hold onto their existing assets, margins are shrinking. Rising interest rates, inflation, and modest rental growth have left many Melbourne landlords treading water.

Traditional property managers — while effective at keeping tenants in place and properties maintained — are not incentivised to maximise profits. Their remit is stability, not growth.

But as one Melbourne-based management firm has shown, stability is not the same as profitability.

Case Studies: The Profit Gap

Over the past 24 months, hundreds of Melbourne properties have been converted into short-term rentals on platforms such as Airbnb. A rising Melbourne-based agency, Live Luxe, is a prime example of pioneers in this movement. The results have been consistent: higher rental profits with modest upfront investment.

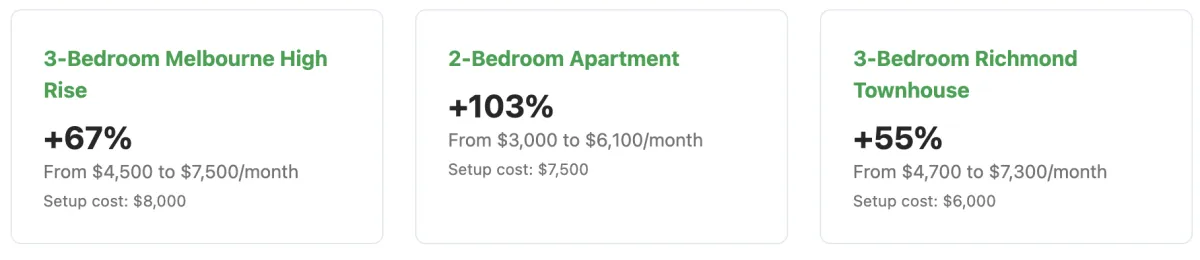

Examples include:

3-Bedroom CBD Apartment

Setup cost: $8,000

Long-term rent: $4,500/month

Short-term rent: $7,500/month

+$3,000/month increase

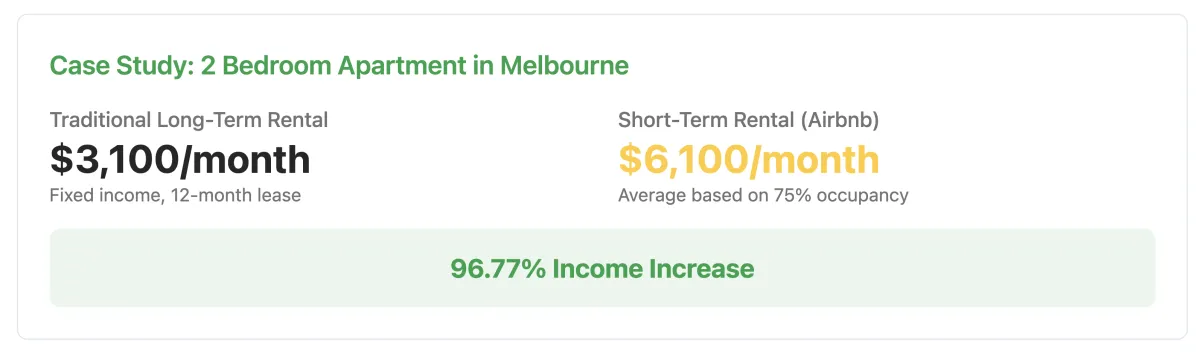

2-Bedroom Suburban Apartment

Setup cost: $7,500

Long-term rent: $3,000/month

Short-term rent: $6,100/month

+$3,100/month increase

3-Bedroom Richmond Townhouse

Setup cost: $6,000

Long-term rent: $4,700/month

Short-term rent: $7,300/month

+$2,600/month increase

Across all conversions, average profit growth was 63%. Not one owner has opted to return to a long-term lease.

"I honestly didn't think it would make this much difference," says Sarah, a property owner who converted her Fitzroy terrace house to short-term rental six months ago. "I was getting $3,200 per month with my long-term tenant, which seemed fine. But now I'm averaging around $5,100 monthly through Airbnbs."

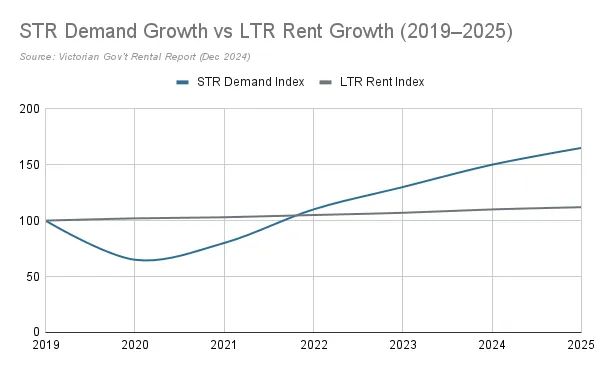

Why 2025 Presents a Unique Window

The short-term rental market in Melbourne has rebounded strongly, fueled by:

The return of international tourism

Growth in domestic travel

Increased business and event-related stays

A Hands-Off Alternative

Specialist firms now manage the entire conversion process end-to-end: compliance, furnishing, listing creation, guest communication, cleaning, maintenance, and pricing optimisation.

For investors, the model is effectively hands-off — comparable to traditional management, but with profits that are materially higher.

Fee structures are typically performance-based, ensuring managers only profit when the owner does.

The Bottom Line

In today’s market, the highest leverage play isn’t buying another property. It’s unlocking the full earning potential of the one you already own.

With margins tightening and demand for short-term rentals climbing, the question for investors is less about whether this model works — and more about whether they can afford to ignore it.

Next Steps

Property investors interested in assessing the potential of their own asset can request a free Property Profit Assessment. The 30-minute consultation includes:

Profitability analysis based on comparable properties

A step-by-step outline of the conversion process

Answers to common questions and risks